Navigating Car Accidents and Insurance Excess in the UK

Experiencing a car accident is undoubtedly a stressful event for any UK driver. Beyond the immediate shock and inconvenience, many drivers are quickly faced with the confusing and often unwelcome reality of car insurance excess UK.

This mandatory contribution towards your repair costs can add significant financial burden at a time when you least expect it. At Finesse Accident Repair Centres, we understand this challenge intimately. We see countless drivers, already shaken by an incident, suddenly confronted with hundreds of pounds in unexpected bills before their vehicle damage repair can even begin.

That’s precisely why Finesse ARC has developed this comprehensive guide. Our aim is to demystify car insurance excess UK, explaining it in clear, simple terms.

More importantly, we want to introduce you to our groundbreaking “We Pay Your Excess” campaign, a unique initiative designed to alleviate this financial stress and ensure a smoother, more efficient accident repair UK process. With Finesse ARC, you can get your car repaired without the worry of upfront excess payments, making your journey back on the road as seamless as possible.

What Exactly is Car Insurance Excess in the UK?

In the simplest terms, car insurance excess is the portion of the repair bill that you, the policyholder, agree to pay when making a claim on your car insurance. Once you’ve covered this agreed amount, your insurer will then pay the remaining balance of the repair costs. It’s your direct contribution towards the claim.

Example: Imagine your car suffers damage requiring £1,000 worth of repairs, and your insurance policy has an excess of £250. You would pay the £250, and your insurer would then cover the remaining £750. This system is a standard part of the car insurance claim process across the UK.

For a detailed breakdown, see What is excess in insurance? | MoneyHelper

Compulsory vs. Voluntary Excess: Understanding Your Contribution

When Do You Pay Your Car Insurance Excess?

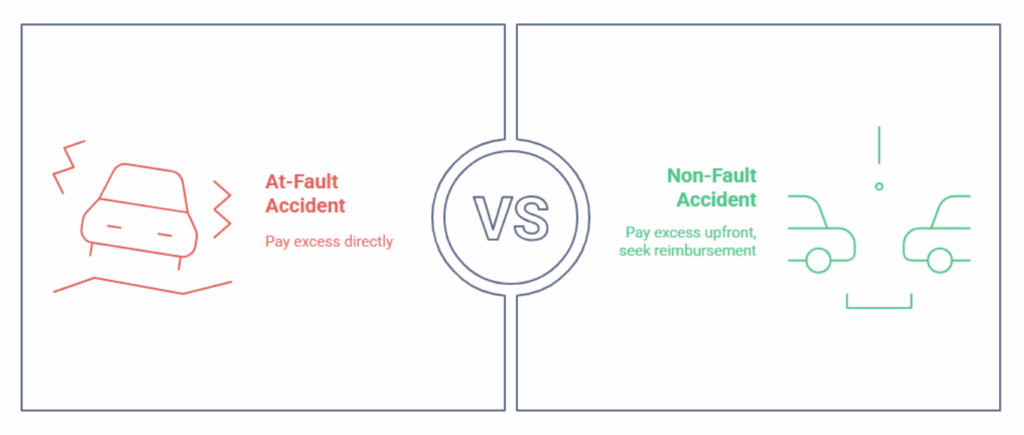

This is a common area of confusion for many drivers. The timing of your excess payment often depends on whether you were at fault for the accident:

At-fault accident: If you are deemed responsible for the accident, you will almost always be required to pay your car insurance excess directly to your insurer or repairer.

Non-fault accident: Even if the accident was not your fault, you might still be asked to pay your excess upfront. In these situations, your insurer will typically attempt to recover these costs from the at-fault driver’s insurance company.

While you should eventually be reimbursed, this process can take weeks or even months, leaving you out of pocket during a challenging time. This is a key reason why many drivers seek accident repair without upfront costs.

The Real Headache: Why Car Insurance Excess Stresses UK Drivers

Through our extensive experience helping drivers across the UK, we’ve identified the main frustrations associated with car insurance excess:

- Unexpected financial burden: Having to suddenly pay hundreds of pounds after an already traumatic event.

- Delayed reimbursement: The long wait times for reimbursement in non-fault cases, which can tie up your funds for extended periods.

- Added stress and delays: The financial worry and administrative hassle can significantly delay getting your vehicle damage repair completed and getting you back on the road.

These are the very reasons Finesse ARC developed the “We Pay Your Excess” offer to transform the accident repair UK experience.

Finesse ARC’s “We Pay Your Excess” Campaign: Your Solution for No Upfront Excess

At Finesse Accident Repair Centres, we firmly believe that drivers should not have to endure the additional financial pressure of car insurance excess after an accident. Our innovative “We Pay Your Excess” campaign is designed to remove this burden entirely, offering a truly stress-free car repair without excess solution.

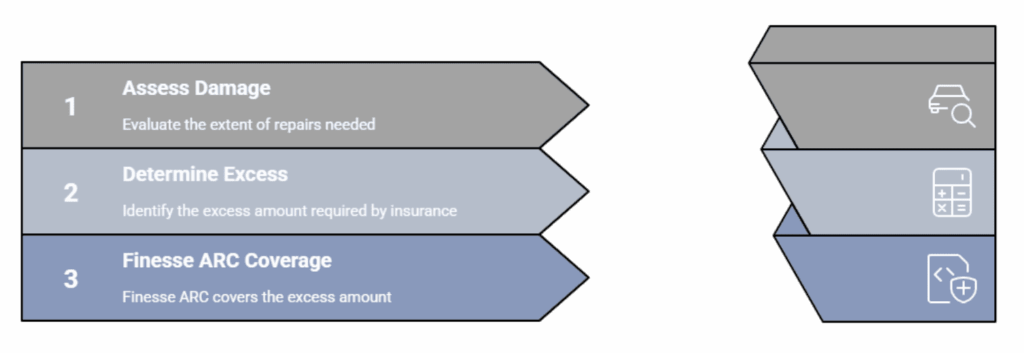

How our campaign helps you:

We are proud to be trusted by leading automotive brands such as Audi, BMW, Tesla, Volkswagen, and Volvo, among many others. Regardless of your car’s make or model, our expert technicians are committed to restoring your vehicle to its original safety and quality specifications. This commitment makes us a premier choice for accident repair UK.

Learn more about our exclusive offer: Finesse ARC – We Pay Your Excess Offer

Real-Life Scenarios: Accident Repair Without Upfront Costs

Let’s look at how Finesse Accident Repair Centre’s “We Pay Your Excess” campaign makes a tangible difference:

At-Fault Accident Example: A driver accidentally reverses into a post, resulting in £800 worth of repairs and a £300 excess. Normally, the driver would pay £300. With Finesse ARC, we cover this excess for you.

Non-Fault Accident Example: Your car is hit by another vehicle, leading to £1,500 in repairs. Your insurer requests a £250 excess upfront, which you’d typically wait months to reclaim. With Finesse ARC, we cover the excess for you, eliminating the wait and the financial strain.

This is the essence of no upfront excess accident repair.

FAQs

Do I always have to pay excess for car repairs?

Normally, yes, your insurer requires it. However, when you choose Finesse ARC for your vehicle damage repair, we cover your excess, so you don’t have to.

Can I get my excess back after a non-fault accident?

While it’s possible, the reimbursement process can be lengthy and frustrating. Many drivers prefer the peace of mind offered by an approved repairer like Finesse ARC, who removes the upfront excess payment.

Does paying excess impact my no-claims bonus?

Your no-claims bonus is affected by whether a claim is made against your policy, not by the payment of the excess itself. Making a claim, especially an at-fault one, is what typically impacts your bonus.

What if I can’t afford my car insurance excess?

Insurers often won’t release your repaired vehicle until the excess is paid. With Finesse ARC, this significant worry disappears, as we handle the excess payment for you, ensuring a smooth collection of your repaired car.

Why choose Finesse ARC for accident repair in the UK?

Because we combine unparalleled expertise in accident repair UK with a steadfast customer-first promise: we pay your excess, so you don’t have to. We offer high-quality, manufacturer-approved repairs and a truly stress-free experience.

Stress-Free Accident Repair with Finesse ARC: Your Trusted Car Body Shop UK

Car insurance excess in the UK remains a complex and often unfair aspect of post-accident recovery for drivers. While insurance companies dictate the rules, Finesse Accident Repair Centres are actively changing the experience. With our unique “We Pay Your Excess” offer, you are shielded from unexpected costs, frustrating delays, and unnecessary stress, allowing you to focus on what matters most, getting your life back to normal.

Benefits of Choosing Finesse ARC:

Ready for a smoother, stress-free repair experience? Contact Finesse ARC today and let us take care of everything. Your trusted car body shop UK is here to help you get back on the road with confidence.

Related Articles

Manufacturer Approved Accident Repair Redhill

Why Choosing a Manufacturer Approved Accident Repair Centre in Redhill Matters for Your Car’s Future When you are involved in a car accident, [...]

How to Keep Your Car Warranty Intact After an Accident

Beyond the damage, what happens to your car warranty? An accident is more than just a dented bumper or a cracked headlight. It's [...]

Car Body Repair in Dorking

Why Dorking Drivers Choose Finesse for car body repairs In today’s world, drivers expect more than just quick fixes - they expect genuine [...]

We are a proud sponsor of the Tesla Owners Club

Finesse is a proud sponsor of the Tesla Owners Club. A reflection of our commitment to electric vehicle excellence.

As one of the UK’s largest Tesla approved accident repair centres, we provide expert, manufacturer-standard repairs with advanced equipment and certified EV technicians.

We serve Tesla owners across London and the South East with precision repairs you can trust.